This is a lifetime mortgage. To understand the features and risks, ask for a personalised illustration.

Bank of England Holds Base Rate at 5%

20 Sep 2024

With UK inflation remaining at 2.2% which is slightly above the Bank of England’s 2% target, the decision was made on Thursday 19th September to keep the base rate at 5%.

Mortgage holders consider equity release for care needs in later life

27 Aug 2024

According to recent findings by LV= where 4,000 UK adults were surveyed, mortgage holders said that were likely to consider equity release to free up some money to take care of expenditures in later life.

Steps for decluttering your home

6 Aug 2024

Did you know that removing clutter within your home can reduce stress, help you be more productive, and improve your mood and self-esteem? Check out our steps to get you started.

61% UK homeowners are looking at equity release

22 Jul 2024

The Equity Release Council has revealed that three in five UK homeowners are interested in releasing money from their property later in life.

Looking to Extend?

2 Feb 2024

Are you looking to extend your property? There are many benefits to adding an extension to your existing home, here are a few.

Is Bridging Finance A Good Idea? | FAQ's Answered

12 Apr 2022

To help anyone who is interested in equity release, below we have answered three of the most commonly asked questions.

Commonly Asked Questions About Equity Release In Later Life

4 Apr 2022

To help anyone who is interested in equity release, below we have answered three of the most commonly asked questions.

Using Equity Release To Buy A Second Home | How Much Do You Need?

31 Mar 2022

If you’re over 55 years of age and have considerable equity in your home, you may be wondering; ‘can I use equity release to buy a second home?’.

Common Reasons Why People Consider Equity Release

21 Mar 2022

You may have heard of the term ‘equity release’ and simply put, this is the process of releasing some of the money that is tied up in your home.

5 Common Reasons Why People Consider Equity Release

9 Mar 2022

Purchasing a property and then letting it out to tenants is a great way to earn additional income and the more properties you own, the more you can earn.

The Latest Interest Rate Cut and How it Affects You.

Generally referred to as ‘the base rate’, when it falls it is usually (but not always) an indication that lending rates generally will also fall.

Mortgage Required Launch Video Appointments

If you can’t come to us we can quickly set up a video or phone appointment.

What is a Drawdown Lifetime Mortgage?

Lifetime mortgages are becoming more popular as a generation of people with all or most of their lifetime wealth tied up in their homes.

Can I Port an Equity Release Mortgage?

With most Equity Release mortgages it’s likely that the loan is increasing in size as interest on money you have borrowed on the mortgage accrues. However, this doesn’t mean that you can’t port your mortgage to another, perhaps smaller, property.

What is a Home Reversion Plan?

A Home Reversion Plan allows you to access all or part of the value of your property whilst, at the same time, retaining the right to remain in your property, rent free, for the remainder of your life.

How Much Can I Borrow with an Equity Release Loan?

Equity release is a way to release money by way of a loan secured on your home or through the sale of all or part of your home, subject to certain rights to remain in occupation.

Reasons Why Our Clients use an Equity Release Loan.

In simple terms, Equity Release lending enables you to release and use some of the equity tied up in your home whilst still allowing you to remain living there during your lifetime.

Who are the Equity Release Council

The Equity Release Council is a not-for-profit organisation and is the recognised industry body for the equity release mortgage sector.

What is a Lifetime Mortgage and How does it Work?

A lifetime mortgage is a loan made to older applicants which is secured on their home. You have the option not to repay it on a monthly basis but, instead, the interest can be rolled-up over the remainder of your life.

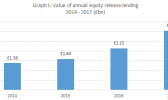

Equity Release Lending Record High 2017

Equity release records broken as unprecedented Q4 activity sees 2017 lending reach £3.06bn with annual growth at a 15-year high.

Mortgage Required Join the Equity Release Council

We are delighted to be able to announce that Mortgage Required has joined the Equity Release Council.

Is Equity Release a Good Idea?

Equity release is a way for pensioners to release money by way of a loan secured on your home or through the sale of all or part of your home.

Borrowing Into Retirement

23 Feb 2017

The Insurance giant Prudential recently carried out research which found that 25% of 2017s retirees will retire in debt. This is at its highest level for seven years.

Equity Release has never been so popular. What is it?

9 Nov 2016

Equity release is a term given to the mechanism by which a homeowner can raise either a cash lump sum or a regular periodic income in return for either selling or mortgaging all or part of their home.

Equity Release is More Popular than Ever

25 Feb 2016

There is only one subject for me to write about this week and that’s “Equity Release.” At Mortgage Required, we get all sorts of enquiries, but never before have we had so many enquires of this nature. It seems that so many retired people are “asset rich/ penny poor” and they are looking for a way to get their hands on some of their equity.

Lending into Retirement

16 Nov 2015

The Building Society Association (BSA) announced that they are reviewing age limits on mortgages as more customers demand longer mortgage terms in order to keep monthly costs down. Older homebuyers may soon find it easier to get a mortgage as many lenders currently insist mortgages are repaid prior to the borower’s planned retirement dates.

Debt Consolidation

17 Jul 2015

The Financial Conduct Authority (FCA) have strict rules about consolidating debts into client’s mortgages on the basis that if you default on your car loan, the finance company will come and reposes your car, but default on your mortgage and you may of course lose your home!

Lifetime Mortgages

27 Nov 2014

I think anyone with an interest only mortgage without a repayment vehicle, will by now have a letter from their lender, warning them to make arrangements to repay their capital.

Nowadays, banks and building societies are reluctant to give mortgages to customers unless they pay capital as well as interest, but back in the day, interest only mortgages were as common as muck!

Shared Equity

25 Oct 2013

Back in the day, “Shared Equity” was considered a little down market, perhaps where one might go as a step up from renting – a helping hand onto the housing ladder.

Recent posts

Skipton Building Society launches ‘Delayed Start’ mortgage meaning first time buyers won’t be required to make repayments for the first three months.

According to a survey by Skipton, first time buyers who bought their home in the last five years found that in the first three months of living there, they were spending upwards of £30,000.

Gardening Tips for Beginners

5 days ago

If you have recently moved into a property with a garden that requires a little TLC, or you’d like to get on top of your current green space, check out our tips.

The Family-Backed Mortgage from NatWest

8 days ago

High street lender, NatWest, have launched a new product to help first-time buyers purchase a property with assistance from a family member or friend to get them on the property ladder sooner.

‘Buy Now, Pay Later’ (BNPL) schemes, such as ‘Klarna’ are short-term loans that allow shoppers to make a purchase, but delay paying for it for an agreed amount of time.

Klarna is one of the most popular BNPL services with 18 million customers in the UK alone, and offers interest-free payment options which is appealing to shoppers. However, does it affect a mortgage application?

Buy to Let mortgages: what's happening?

14 days ago

We look at how to get the best Buy to Let mortgage rate, what's in store going forward, and options as a landlord with increasing costs.

UK mortgage rates following Trump’s Tariffs

23 days ago

Throughout this past week, lenders have continued to reduce their mortgage rates giving borrowers in the UK some welcome news following the change in global tariffs under US President, Donald Trump.

Effective ways to relieve stress

23 days ago

Did you know that buying a house, or relocating is in the top 10 most stressful life events?

Stress of course is an unavoidable part of life and there are many reasons why people experience stress, not just buying a house!

There are lots of effective ways to manage and reduce stress, check out our tips to help you.

With the stamp duty relief ending in England and Northern Ireland, we have listed the top 10 cheapest areas for first-time buyers as published by Rightmove.