Regularly referred to as an EPC, the Energy Performance Certificate was introduced by the UK government in an attempt to undertake periodic audit of the UK’s built environment and to assess its energy efficiency and nudge/require* property owners to improve the energy efficiency of their property.

A property owner must have a valid EPC whenever a property is built, sold or let.

An Energy Performance Certificate contains:

- information about a property’s energy use and typical energy costs

- recommendations about how to reduce energy use and save money

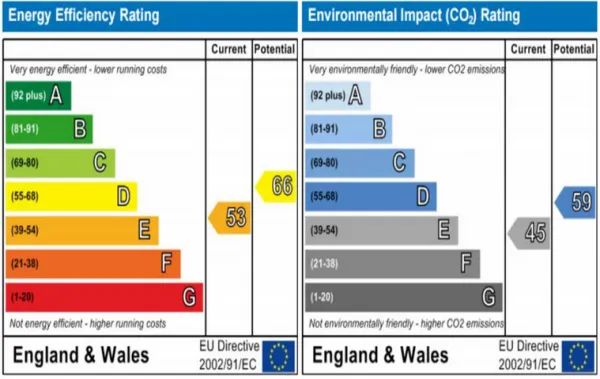

- An EPC gives a property an energy efficiency rating from A (most efficient) to G (least efficient) and is valid for 10 years.

At present, the following buildings do not require an EPC:

- Places of worship

- Temporary buildings that will be used for less than 2 years

- Stand-alone buildings with total useful floor space of less than 50 square metres

- Industrial sites, workshops and non-residential agricultural buildings that don’t use a lot of energy

- Some buildings that are due to be demolished

- Holiday accommodation that’s rented out for less than 4 months a year or is let under a licence to occupy

- Listed buildings - you should get advice from your local authority conservation officer if the work would alter the building’s character

- Residential buildings intended to be used less than 4 months a year

- Unsafe properties

*Current regulations relating to EPCs include prohibition of the renting of property that does not have an energy rating of band E or better. Failure to comply with these regulations can result in significant fines of up to £5,000.

Related article:

Recent posts

World Sleep Day Tips

Today

There are many people who struggle with getting a good night’s sleep. Having poor sleep hygiene can be the reason for bad sleep quality in adults. Sleep hygiene refers to habits that can help you sleep better.

Here we have shared some tips to create a healthier sleep.

What you need to know about remortgaging

2 days ago

If your current fixed rate is due to come to an end within the next six months, you will want to start thinking about the options available to you.

Best UK Mortgage Rates this Week

8 days ago

Here are the lowest fixed mortgage rates of the week, available to first-time buyers, home movers, buy-to-let, and those remortgaging.

Call us for more information: 01628 507477 or email: team@mortgagerequired.com.

Nationwide is the first lender to allow mortgage deeds to be signed electronically and without the need for a witness.

‘My First Mortgage’ from major high-street lender Santander is specifically for those wanting to buy their first property. It allows first-time buyers to purchase 98% of the property’s value. However, certain criteria must be met to be eligible.

Maidenhead, Berkshire – 26th January 2026 – Dedicated independent mortgage experts, Mortgage Required, are delighted to have acquired fellow experienced brokerage, Y-Not Finance.

The acquisition connects two well-respected brokerages, both with a wealth of experience and shared values, to continue providing the best advice on all aspects of the mortgage market.

As part of the UK government’s plans to change the leasehold system to help families struggling with unaffordable ground rent costs.

The Prime Minister announced this morning (27 January) that ground rents will be capped at £250 per year, reverting to a peppercorn rate after 40 years.

Additional borrowing, also known as a further advance, is when you borrow more money on your existing mortgage for a specific reason agreed with your lender.

Here are five of the most common reasons for additional borrowing.