Equity release enables you to release money locked up in your home for any purpose you like. Unlike many other Equity Release Advisers, our experts are also qualified Mortgage Advisers which allows them to discuss every other option of your home finances in an unpressurised environment.

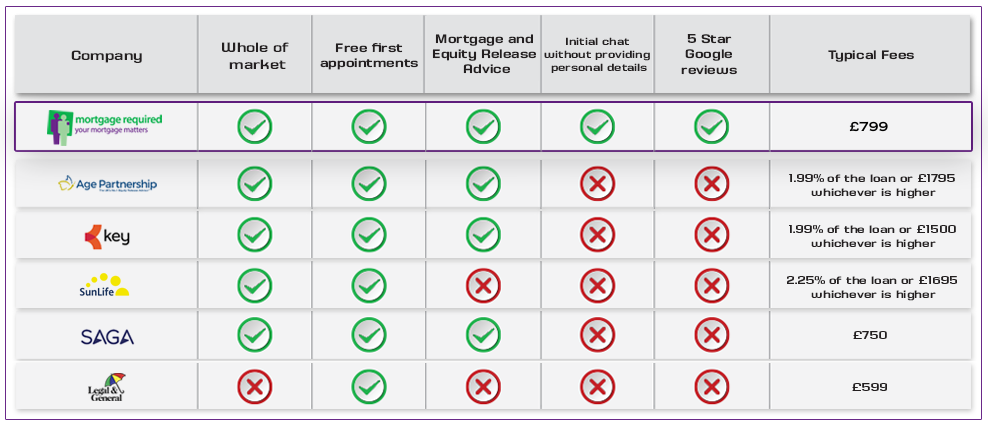

We do not spend thousands on expensive TV advertising or employ celebrities to represent us. This enables us to pass these savings on to you. Also, we are not tied to one lender, we look at a panel of carefully selected lenders but can also access the whole of the market in order to find a suitable product.

We are members of the Equity Release Council who were set up by the government to set high standards in this area of the market. All the products we arrange have a no 'Negative Equity Guarantee' which means you will never owe more than the value of the property. Interest rates can be fixed or capped for the life of the loan.

Call us on 01628 507477 today about Equity Release and start enjoying your retirement.

The Best Equity Release Deals At Mortgage Required | Compare our fees & service

|

|

What is Equity Release?

Equity Release or a lifetime mortgage as they are often called is a way of releasing tax free funds from your home. To qualify you must be over 55 and your home must be worth over £75,000. You can release the money as a lump sum if for example you wish to help your children buy their first home or want to buy a motorhome. Another option is to take the money in stages so if you don’t need all the money now you could take a smaller lump sum then draw down further funds as and when you need them. The advantage with this plan is that you will only be charged interest on the money you have actually received. You do not need to make any monthly repayments instead the loan plus the roll up interest is repaid at the end of the plan. This happens when either you or (if you are a couple) the last remaining borrower passes away or goes into long term care.

Are there other options in retirement?

Depending on your personal and financial situation there are a number of other options available to you. If you are receiving an income perhaps through a private pension you may be able to mortgage your property in the normal way. One option to consider is a Retirement Interest Only mortgage known as a RIO and as with Equity Release you must be over 55 to qualify. With this option the amount borrowed is paid back when the last remaining applicant passes away or enters long term care. This is usually from the proceeds of the sale of the property. All our Later Life Lending experts are qualified to give advice on Equity Release, RIO and Standard Residential Mortgages. Crucially this allows them to discuss every possible option available to you.

Can I make monthly payments or pay back all or part of the Equity Release loan?

Many providers have products that allow you to pay all or part of the loan back at any time should you wish to. Please note that this is often subject to a penalty. Whilst most Equity Release products are designed to have no monthly repayments, many offer the ability to make payments if you wish, which can reduce the eventual lump sum and interest owed. Your Equity Release Adviser will discuss this with you.

Will I still own my home?

As with most mortgages the lender will use your property as security for the money they are lending you, however the property is still owned by you. If you opt for a lifetime mortgage , the most popular form of Equity Release you will have the right to stay in your home for life or until you go into long term care. All of our Equity release Products offer a no negative Equity Guarantee meaning you will never owe more than your home is worth and none of the debt can be passed on to your loved ones. With most plans it is even possible to move home, this will be subject to criteria with the security passing from your current home to your new one.

Can I be evicted if I owe more than my home is worth?

As members of the Equity Release Council all the products we arrange offer a "No Negative Equity Guarantee". This means that no matter what happens to house prices or how much interest is accrued, you will never owe more than the value of your home. All products come with security of tenure for life.

Will my children still receive an inheritance?

Many people use Equity Release to help their children when they really need the money, for example when they are buying their first home. For others who want to make sure there is something left to cover funeral expenses or to pass on a percentage of the property value to a loved one, providers offer an Inheritance Protection Option. We will be happy to discuss this with you.

What are the risks involved?

Taking out any type of loan should be considered carefully, it should not be rushed into and certainly should not be considered until you are aware of all of the risks and responsibilities involved. At Mortgage Required we understand this. We will take the process at your pace and if having discussed all of the options available and we agree that it’s not right for you, no problem. We are here to help you make the right decision. If you initially want to have a chat without handing over any of your details that’s fine too. Equity Release products have come a long way in the past few years and it is now regulated by The Financial Conduct Authority (FCA). As an extra layer of protection for our clients we are members of the Equity Release Council and will only sell products approved by them.

More information

Trusted by

Subscribe to our newsletter

Sorry, this form requires you to accept Analytics and Functional cookies before it can load. Click here to allow these types of cookie.