- Market sees over 37,000 new customers as total lending in 2017 reaches £3.06bn

- Q4 2017 marks historic end to the year with record lending of £838m and a milestone of over 10,000 new customers for the first time

- Across 2017, the sector supported almost 67,000 customers seeking to unlock part of their housing wealth to manage their finances in later life

- Drawdown products remain the most common type of new product, favoured by 75% of new customers in Q4 2017

- Fewer customers make additional drawdowns or seek further advances compared with Q3

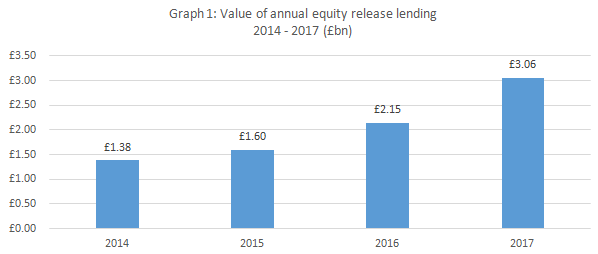

A record quarter for equity release activity in Q4 2017 pushed annual lending growth in the sector to its highest level since 2002, according to year-end lending figures¹ from Equity Release Council (The Council). As a result, the total amount of housing wealth unlocked by over-55 homeowners reached £3.06bn in 2017 – the first time it has exceeded £3bn in a single year.

Lending via equity release plans in Q4 2017 amounted to over £838million, the highest level on record for any single quarter, as UK homeowners use their housing wealth to support their finances in later life. This contributed to overall annual lending growth of 42% when compared to £2.15bn during 2016.

The final three months of 2017 also saw an unprecedented number of new equity release customers, exceeding 10,000 for the first time in a single quarter (10,327). This represented a 4% increase from 9,905 in Q3 2017 and almost a quarter (24%) compared to 8,303 new customers in Q4 2016.

These increases meant the total number of new equity release plans agreed in 2017 was up 34% on 2016 from 27,563 to 37,037: the highest total on record and the biggest percentage rise since 2003.

Overall, the sector supported almost 67,000 customers during 2017, with 25,794 existing drawdown lifetime mortgage customers returning to dip into agreed reserves, and 3,867 existing customers agreeing further advances on either lump sum, drawdown or home reversion plans.

Trends in new equity release plans agreed

Drawdown lifetime mortgages remain the most popular type of product, representing 75% of new plans agreed in Q4 2017, up from 64% in Q4 2016. Across 2017 as a whole, 71% of new customers opted for drawdown plans, which typically see smaller amounts of housing equity withdrawn initially compared with lump sum plans, with an extra amount reserved for future use – thereby limiting the interest owed as it is only charged on funds as they are withdrawn.

New drawdown customers agreed an average initial instalment of £62,359 in Q4, a rise of 6% year-on-year from £59,002 in Q4 2016, but down by 4% on Q3 2017 (£64,973). One in four (25%) new customers opted instead for a lump sum lifetime mortgage in Q4, with the average loan amount of £101,913 relatively stable compared with Q3 (£100,389) – a rise of 2% – and up 8% year-on-year from £94,330 in Q4 2016.

Across all new customers, the continuing trend towards drawdown products as a way to release housing equity in smaller instalments meant that – despite the overall growth of lending activity – average lending per customer was stable year-on-year at £72,217 in Q4 2017 compared with £71,627 in Q4 2016.

Trends in returning drawdown customers and further advances

The Council’s data shows that the number of returning drawdown customers dipping into their agreed reserves decreased by 7% in Q4 from 6,849 in Q3 to 6,360. At the same, the number of existing customers seeking further advances on existing loans also dropped 16% from 1,138 in Q3 to 961.

The average drawdown instalment taken by returning customers was £10,853 in Q4 – broadly in line with the average across 2017 (£10,542). Further advances made up the smallest part of overall market activity, with the average lump sum amount agreed being £20,171 in Q4, down 7% from £21,757 a year earlier. The average drawdown further advance was £21,991, up by 4% from £21,066 in Q4 2016.

David Burrowes, Chairman of the Equity Release Council, commented:

“The record-breaking demand for equity release over the past year is testament to the fact more consumers are changing the way they plan financially for retirement, and taking a broader range of options into consideration. This is illustrated by the continued popularity of drawdown products, with many customers viewing equity release as a reliable source of income in later life.

“Importantly, the evolving mindset of consumers is helped by the flexibility to use housing wealth for a range of purposes, and the rigorous safeguards and customer protections in place across the market. Consumers also have more choice than ever before – driven by the increasing number of providers that has, in turn, increased the range of product options and helped to push interest rates to new lows.

“Property is, for many people, their largest asset and has the potential to play an ever-greater role in the future to meet the challenge of ensuring effective later life funding. I look forward to working with our members and industry, regulators and government across 2018 to build on what has been a breakthrough year for the sector.”

Related articles:

Recent posts

According to Zoopla, four in 10 homes are now cheaper to buy with a mortgage than to rent due to lower-cost mortgages - a sign that ownership is becoming more affordable.

Best UK Mortgage Rates this Week

Yesterday

Here are the lowest fixed mortgage rates of the week, available to first-time buyers, home movers, buy-to-let, and those remortgaging.

Call us for more information: 01628 507477 or email: team@mortgagerequired.com.

World Sleep Day Tips

7 days ago

There are many people who struggle with getting a good night’s sleep. Having poor sleep hygiene can be the reason for bad sleep quality in adults. Sleep hygiene refers to habits that can help you sleep better.

Here we have shared some tips to create a healthier sleep.

What you need to know about remortgaging

9 days ago

If your current fixed rate is due to come to an end within the next six months, you will want to start thinking about the options available to you.

Nationwide is the first lender to allow mortgage deeds to be signed electronically and without the need for a witness.

‘My First Mortgage’ from major high-street lender Santander is specifically for those wanting to buy their first property. It allows first-time buyers to purchase 98% of the property’s value. However, certain criteria must be met to be eligible.

Maidenhead, Berkshire – 26th January 2026 – Dedicated independent mortgage experts, Mortgage Required, are delighted to have acquired fellow experienced brokerage, Y-Not Finance.

The acquisition connects two well-respected brokerages, both with a wealth of experience and shared values, to continue providing the best advice on all aspects of the mortgage market.

As part of the UK government’s plans to change the leasehold system to help families struggling with unaffordable ground rent costs.

The Prime Minister announced this morning (27 January) that ground rents will be capped at £250 per year, reverting to a peppercorn rate after 40 years.